As a digital nomad, you're likely no stranger to the freedom and adventure that comes with working remotely from anywhere in the world. However, with this lifestyle comes a unique set of challenges, including finding reliable and comprehensive health insurance that covers you globally. In this article, we'll explore the best travel insurance options for digital nomads, with a focus on SafetyWing's Nomad Insurance and Nomad Health plans.

What to Look for in Travel Insurance for Digital Nomads

When shopping for travel insurance as a digital nomad, there are several key factors to consider:

- Global coverage: Look for a plan that covers you in 175+ countries, including your home country.

- Comprehensive coverage: Ensure the plan includes coverage for emergencies, routine medical care, and preventive care.

- Flexibility: Choose a plan that allows you to customize your coverage to fit your needs and budget.

- 24/7 support: Opt for a plan with a responsive customer support team that's available to help you anytime, anywhere.

SafetyWing Nomad Insurance

SafetyWing's Nomad Insurance is a popular choice among digital nomads, offering comprehensive coverage at an affordable price. Here are some key features of the plan:

- Global coverage in 175+ countries, including limited coverage in the US

- $250,000 maximum limit per policy

- Coverage for emergencies, including hospital stays, surgeries, and evacuations

- Coverage for routine medical care, including doctor visits, prescriptions, and preventive care

- 24/7 customer support

SafetyWing Nomad Health Standard and Premium Plans

In addition to their Nomad Insurance plan, SafetyWing also offers two Nomad Health plans: Standard and Premium. Here are some key features of each plan:

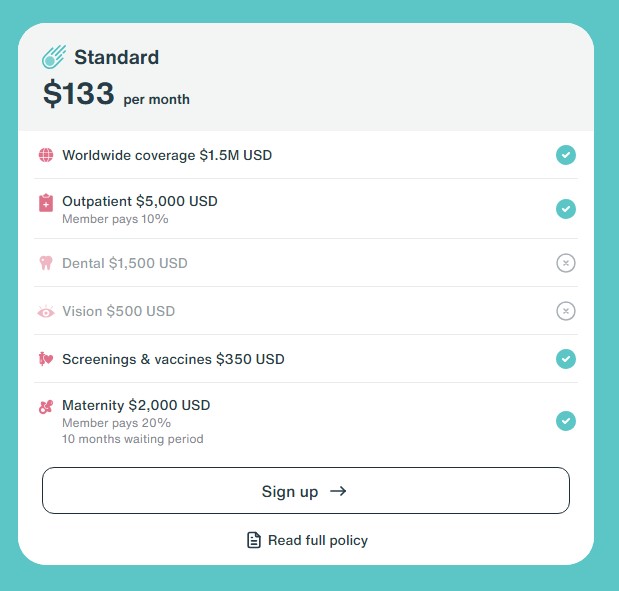

Standard Plan:

- $133 per month (18-39 years old)

- Worldwide coverage $1.5M USD

- Outpatient $5,000 USD

- Dental $1,500 USD

- Vision $500 USD

- Screenings & vaccines $350 USD

- Maternity $2,000 USD (10 months waiting period)

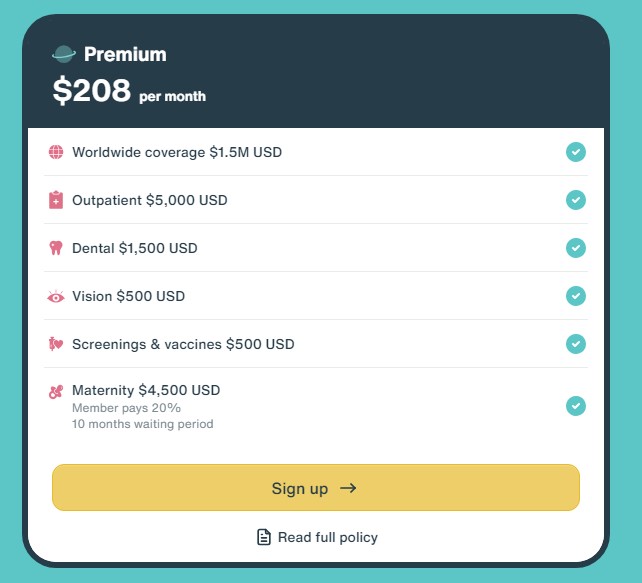

Premium Plan:

- $208 per month (18-39 years old)

- Worldwide coverage $1.5M USD

- Outpatient $5,000 USD

- Dental $1,500 USD

- Vision $500 USD

- Screenings & vaccines $500 USD

- Maternity $4,500 USD (10 months waiting period)

Both plans offer comprehensive coverage, including emergency and routine medical care, as well as preventive care and maternity coverage.

Why Choose SafetyWing?

SafetyWing is a popular choice among digital nomads due to its comprehensive coverage, flexible plans, and responsive customer support. Here are some reasons why you might consider SafetyWing for your travel insurance needs:

- Global coverage: SafetyWing offers coverage in 175+ countries, including limited coverage in the US.

- Comprehensive coverage: SafetyWing's plans cover emergencies, routine medical care, and preventive care.

- Flexible plans: SafetyWing offers a range of plans to fit your needs and budget.

- 24/7 support: SafetyWing's customer support team is available to help you anytime, anywhere.

Conclusion

As a digital nomad, finding reliable and comprehensive health insurance is crucial to ensuring your safety and well-being on the road. SafetyWing's Nomad Insurance and Nomad Health plans offer a range of options to fit your needs and budget, with comprehensive coverage and 24/7 support. Whether you're looking for emergency coverage or routine medical care, SafetyWing is a great choice for digital nomads.